A new White House report reveals that artificial intelligence software used by property management companies is costing U.S. renters billions through artificially inflated rental prices.

The report by the White House Council of Economic Advisers (CEA) found that RealPage, a property management software owned by private equity firm Thoma Bravo, uses AI algorithms to recommend rental prices based on competitor data. This practice results in renters paying an average of $70 more per month, or 4% higher rent nationally.

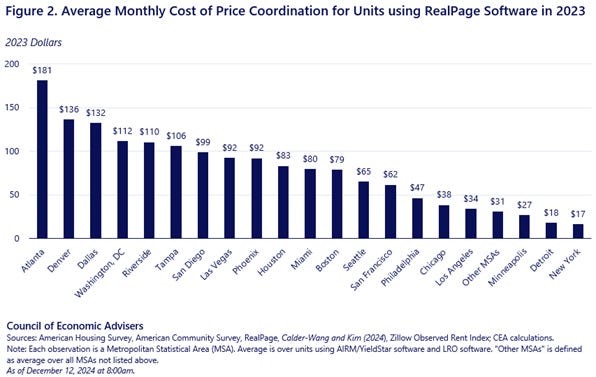

Nearly 25% of multi-family rental units across the country use RealPage's pricing algorithm. In major metropolitan areas like Atlanta and Dallas, adoption exceeds 50% of units. The impact is even more pronounced in cities like Denver, Washington DC, Riverside, and Tampa, where the AI-driven price increases surpass $100 monthly per unit.

The Department of Justice (DOJ), along with eight state Attorneys General, filed an antitrust lawsuit against RealPage in August. The lawsuit alleges the company orchestrated an "unlawful scheme to decrease competition among landlords in apartment pricing."

While RealPage maintains that property managers have complete discretion to accept or reject its AI pricing recommendations, evidence from class action lawsuits suggests otherwise. Former leasing agents report that requests to deviate from AI-recommended prices were rejected almost 99% of the time.

Cities are taking action against algorithmic rent-setting. San Francisco and Philadelphia have passed laws prohibiting the use of such software for residential units, with violations carrying substantial fines. Similar legislation is under consideration in San Jose, New Jersey, and San Diego.

The CEA's $3.6 billion estimate likely understates the full impact, as it doesn't account for how RealPage's pricing influences rates at properties not using the software. The findings highlight growing concerns about AI's role in housing affordability across the United States.