Language learning platform Duolingo saw its stock price soar to record levels on Friday following exceptional first-quarter results that highlight the growing global appetite for language education, particularly English learning.

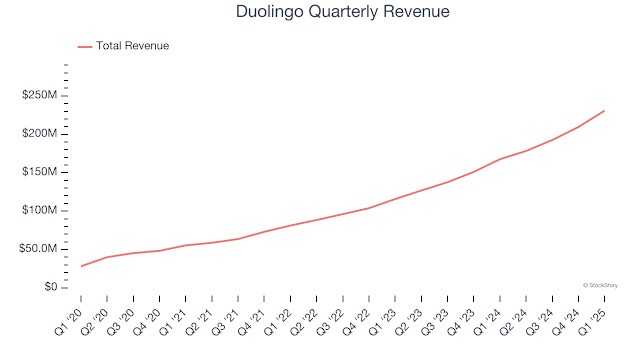

The company's shares jumped 19% to over $477, reaching an intraday peak of $480 - the highest in its history. This surge came after Duolingo reported impressive Q1 earnings of $0.72 per share and revenue of $230.7 million, representing a 38% increase from the previous year.

The platform's user base showed remarkable growth, with paid subscribers increasing 40% to 10.3 million, while daily active users surged nearly 50% to 46.6 million. Both metrics exceeded market expectations.

Based on these strong results, Duolingo has raised its full-year revenue forecast to between $987 million and $996 million, up from its earlier projection of $962.5 million to $978.5 million.

JPMorgan analysts remain optimistic about Duolingo's future growth potential, raising their price target to $500. They point to several growth drivers, including increasing adoption of English lessons and upcoming expansion into non-language content like chess courses.

The company plans to add 148 new language courses to its platform, leveraging generative AI technology to create educational content. This expansion aims to meet the rising global demand for accessible language learning solutions.

The strong performance reflects a broader trend in digital language learning, with English education continuing to be a primary driver of growth. As more people worldwide seek to improve their language skills, Duolingo's platform appears well-positioned to meet this growing demand.