Private health insurance costs will reach new heights in 2025, with premiums averaging $621 monthly or $7,452 annually - a 7% jump from 2024, according to a new ValuePenguin.com analysis.

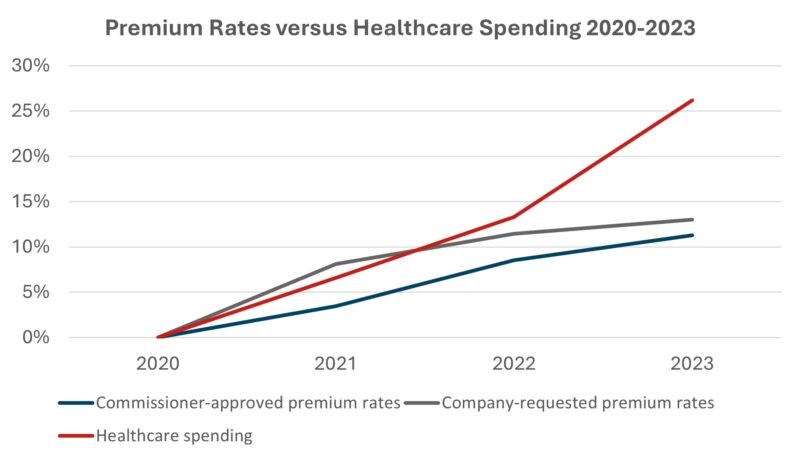

The increase continues a four-year trend that has pushed premiums up 15% since 2022. The rising cost of medical care nationwide has led to premium hikes in 42 states.

All private health plan categories face increases, with Platinum tier, Catastrophic, EPO, HMO, and PPO plans seeing the steepest jumps between 8% and 13%.

Vermont leads the nation with the highest premiums, costing $13,884 annually - 86% above the national average. Alaska and New York follow with rates 75% and 67% above average, respectively. In contrast, New Hampshire, Maryland, and Virginia offer the most affordable options, with premiums 32-40% below the national average.

Eight states will experience premium increases exceeding 10%, with Vermont's 27% spike leading the pack. Meanwhile, six states will see modest decreases, with Iowa, South Dakota, and Alabama reporting reductions between 3-7%.

Despite rising costs, relief exists through subsidies. Over 90% of enrollees qualify for financial assistance, reducing plan costs by more than $800. Four out of five enrollees will pay less than $10 monthly with subsidies.

However, the future of affordable coverage faces uncertainty. The enhanced subsidy program introduced by the American Rescue Plan in 2021, which caps premiums at 8.6% of income, is set to expire in 2025. Without congressional extension, millions could face substantially higher insurance costs from 2026 onward.

The marketplace remains competitive, with 97% of insurance shoppers able to compare plans from three or more insurers for 2025, allowing consumers to find options matching their needs and budget constraints.