Despite rising hourly wages in the United States, persistent inflation continues to diminish workers' purchasing power, painting a concerning picture of real income growth since 2021.

The latest economic data reveals that while private sector hourly wages have steadily climbed, reaching $34.61 by late 2024 from $24.75 in 2015, inflation has consistently eroded these gains, leaving many workers worse off in real terms.

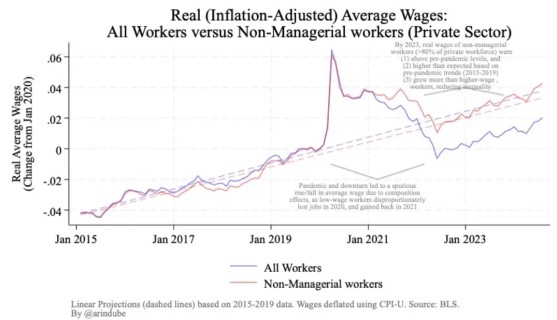

The trend became particularly pronounced in 2022, when inflation soared to 8% while hourly wages grew by only 4.14%, resulting in a substantial 3.86% decline in real wages. This marked one of the largest gaps between wage growth and inflation in recent years, effectively reducing workers' purchasing power despite nominal pay increases.

The pattern continued into 2023, though less severely. Workers saw their hourly wages rise by 3.84%, but with inflation at 4.12%, they still experienced a real wage decline of 0.28%. This meant that despite higher paychecks, employees could buy less with their earnings than before.

Looking ahead to 2024, economists project a slightly more optimistic outlook. With annual inflation expected to moderate to 2.7% and hourly wage growth forecasted between 3.2% and 3.3%, workers may finally see a modest real wage increase of about 0.5%.

The decade-long data shows that from 2015 to 2024, hourly wages rose by approximately $9.86, averaging a 2.24% annual increase. However, these gains have been repeatedly undermined by inflation spikes, particularly during the post-2021 period.

This persistent gap between wage growth and inflation has created ongoing challenges for American workers, who continue to face increased living costs despite higher nominal wages. The situation highlights the complex relationship between wage growth and inflation in the modern American economy.