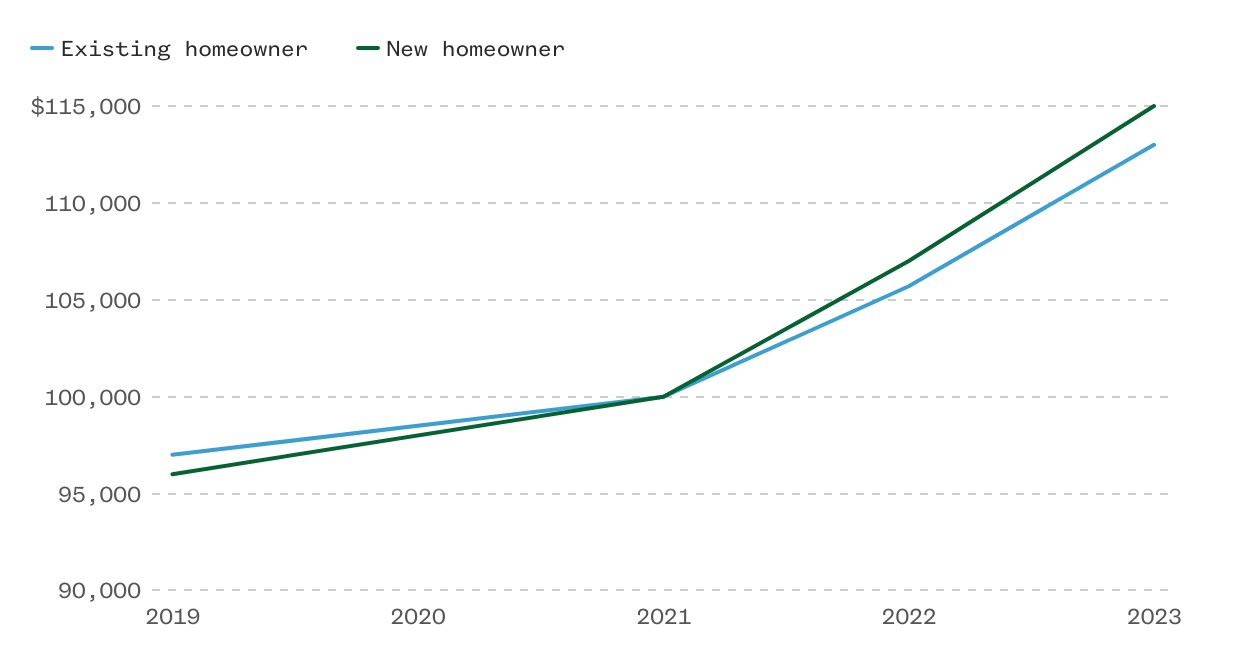

Recent analysis of U.S. Census Bureau data reveals a striking trend in the American housing market - the median income for new homebuyers has surged past $100,000, highlighting growing affordability challenges across the nation.

According to NBC News' analysis, new homebuying households earned a median income of $110,000 in 2023, with buyers under 40 bringing in even more at $114,000. This marks a notable shift where younger buyers now need higher incomes than existing homeowners to enter the market.

The national median income stands at $81,000, while renters earn a median of $62,000, illustrating the widening gap between average earners and those who can afford to purchase homes.

"If you look back a couple of generations, people were able to more comfortably afford housing," notes Chen Zhao, head of economic research at Redfin. She points out that even though Gen Z workers earn more than previous generations at their age, many still find themselves unable to afford homes.

The situation is particularly stark in states like Oregon, where new homebuyers made over $120,000 in 2023 - a 20% jump from 2019. In some Oregon counties, home prices have nearly doubled since the pandemic began.

Even those with six-figure incomes face challenges. Take the Clarks, a dual-income family near Portland who recently purchased a home after a four-year search. Despite their combined income of around $120,000, they encountered numerous obstacles, including being frequently outbid and dealing with inflexible sellers.

The changing landscape affects more than individual buyers. As homeownership becomes increasingly exclusive to high earners, communities face transformation. "When people don't feel ownership, they don't feel as invested," Zhao explains, pointing to broader social implications of this trend.

This shift toward requiring six-figure incomes for homeownership signals deeper economic challenges, potentially contributing to inflation as rising incomes and housing prices create an ongoing cycle of cost increases.

For many Americans, the dream of homeownership now requires not just good credit and a down payment, but increasingly, a place among the nation's top earners.