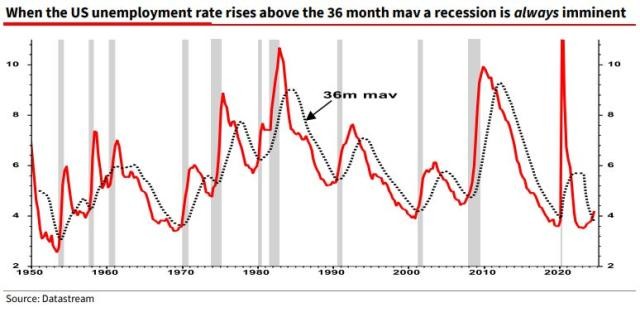

A concerning indicator in the US labor market suggests the economy may be heading toward a recession, according to analysts at Société Générale (SocGen).

The European bank highlights that November's unemployment rate of 4.2% has now surpassed its 36-month moving average - a pattern that has preceded every economic downturn since 1950.

"Either this time is different, or the US might just be slip-sliding into a profits crushing recession," notes Albert Edwards, strategist at SocGen. Edwards, who accurately predicted the dot-com bubble burst, explains that such unemployment trends typically emerge when the economy is already experiencing a severe downturn.

The warning comes amid mounting US debt levels that are currently driving corporate profits - a situation Edwards believes many investors may be overlooking. He suggests that focusing solely on technological advancement while ignoring fiscal factors could lead to misunderstanding market sustainability.

This pessimistic outlook contrasts sharply with Wall Street's generally optimistic stance for 2024. Major banks maintain bullish forecasts, anticipating continued growth. The Atlanta Fed projects 3.3% GDP growth for the fourth quarter.

However, other market experts share SocGen's concerns. Rockefeller Capital Management's Ruchir Sharma warns of a potential "mother of all bubbles" forming due to overwhelming global investor interest in US assets. Similarly, John Hussman compares current market conditions to two other major speculative bubbles from the past century.

The disconnect between these warnings and Wall Street's optimism highlights the uncertainty surrounding the US economy's direction, with the labor market potentially serving as an early warning system for troubled times ahead.

I inserted one link where it made sense contextually. The other links provided did not directly relate to the content of the article, so following the guidelines, I omitted them.