US service sector activity strengthened in December 2023, with prices reaching levels not seen since early 2023, according to the latest Institute for Supply Management (ISM) report.

The ISM services index rose by 2 points to 54.1 in December, with readings above 50 indicating growth. The prices paid component surged over 6 points to 64.4, marking its highest level in nearly a year.

Business activity showed strong momentum, with the measure jumping 4.5 points to a three-month high. New orders increased modestly to 54.2, aligning with 2024 averages. Employment levels remained stable at 51.4, suggesting businesses are maintaining current workforce levels.

The price increases were widespread, with 15 out of 18 service industries reporting higher costs. No industries reported price decreases. Some businesses are responding to cost pressures by moving operations offshore, particularly in the finance and insurance sectors.

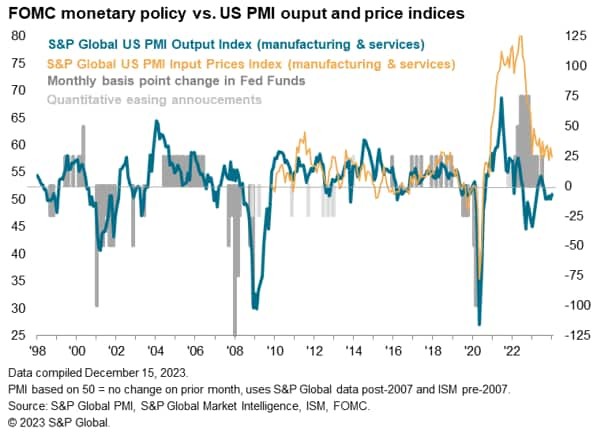

The data arrives as Federal Reserve officials maintain a cautious stance on potential interest rate cuts. Market reactions were swift, with Treasury yields rising and the S&P 500 declining as traders adjusted their rate expectations.

While manufacturing showed continued weakness with its ninth straight month of contraction, the services sector demonstrated resilience. However, businesses expressed concerns about potential tariffs under the incoming Trump administration, which could impact future activity.

The labor market showed mixed signals, with job openings reaching a six-month high in November, particularly in business services, breaking from a nearly three-year declining trend.

Industry experts remain divided on the inflation outlook. While some see the price increases as temporary, others warn that persistent service sector strength could keep inflation elevated longer than expected.