Holiday Spending Hangover: Americans Face Record Credit Card Debt in 2024

A LendingTree survey reveals 36% of Americans accumulated holiday debt averaging $1,181 in 2023, with millennials and parents most affected. Financial experts offer strategic approaches to tackle post-holiday credit card bills through balance transfers, debt repayment methods, and smart savings tactics.

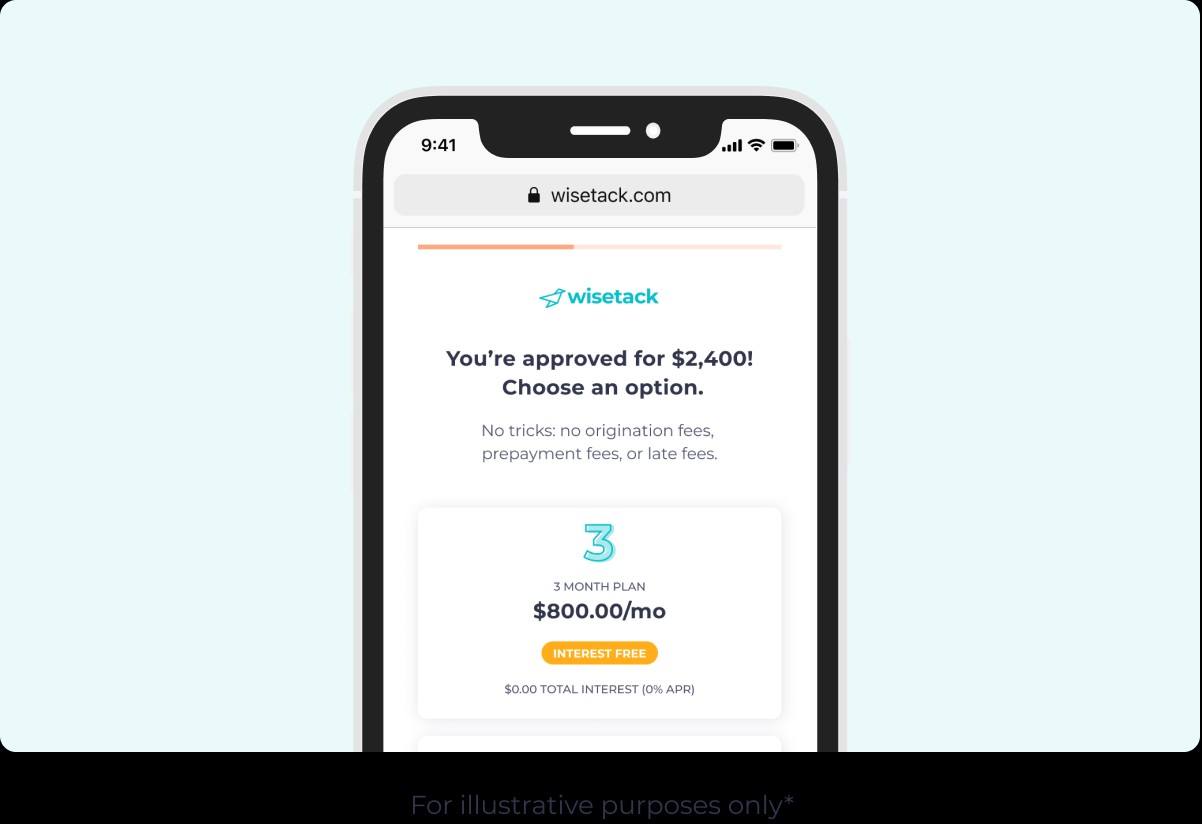

Buy Now, Pay Later Services Expand into Auto Repairs and Healthcare as Inflation Bites

Americans increasingly turn to BNPL payment options for essential car repairs and medical procedures as household budgets tighten under inflation. Auto shops and healthcare providers are partnering with BNPL companies to offer flexible installment plans, though experts urge careful review of terms.

Gen Z's Credit Card Crisis: Young Americans Face Unprecedented Debt Levels

TransUnion data reveals Gen Z consumers aged 22-24 now carry 26% more credit card debt than millennials did at the same age. This growing reliance on credit cards, coupled with high interest rates and rising living costs, poses serious risks to the long-term financial stability of young Americans.

Cash Tops Holiday Wish Lists as Young Americans Prioritize Financial Flexibility

A LendingTree survey reveals that 49% of Americans, particularly Gen Z and millennials, prefer cash gifts this holiday season, with most planning to use it for bills or personal purchases. Economic pressures are reshaping holiday traditions as nearly one-third of Americans opt out of gift-giving due to high costs.

Gen Z's Holiday Shopping Spree: The Rising Debt Crisis Behind Buy-Now-Pay-Later Services

Buy-now-pay-later spending is projected to hit $18.5 billion this holiday season, with Gen Z leading the surge despite mounting debt concerns. Young consumers continue accumulating credit card debt while embracing BNPL services, raising alarms about their financial stability.