The Millionaire Paradox: Why Americans Feel Poor Despite Record Net Worth

Federal Reserve data shows average US household net worth hit $1.06M in 2022, yet financial strain persists for many. The stark contrast between soaring average wealth and median worth of $192,900 reveals growing inequality as costs outpace income growth.

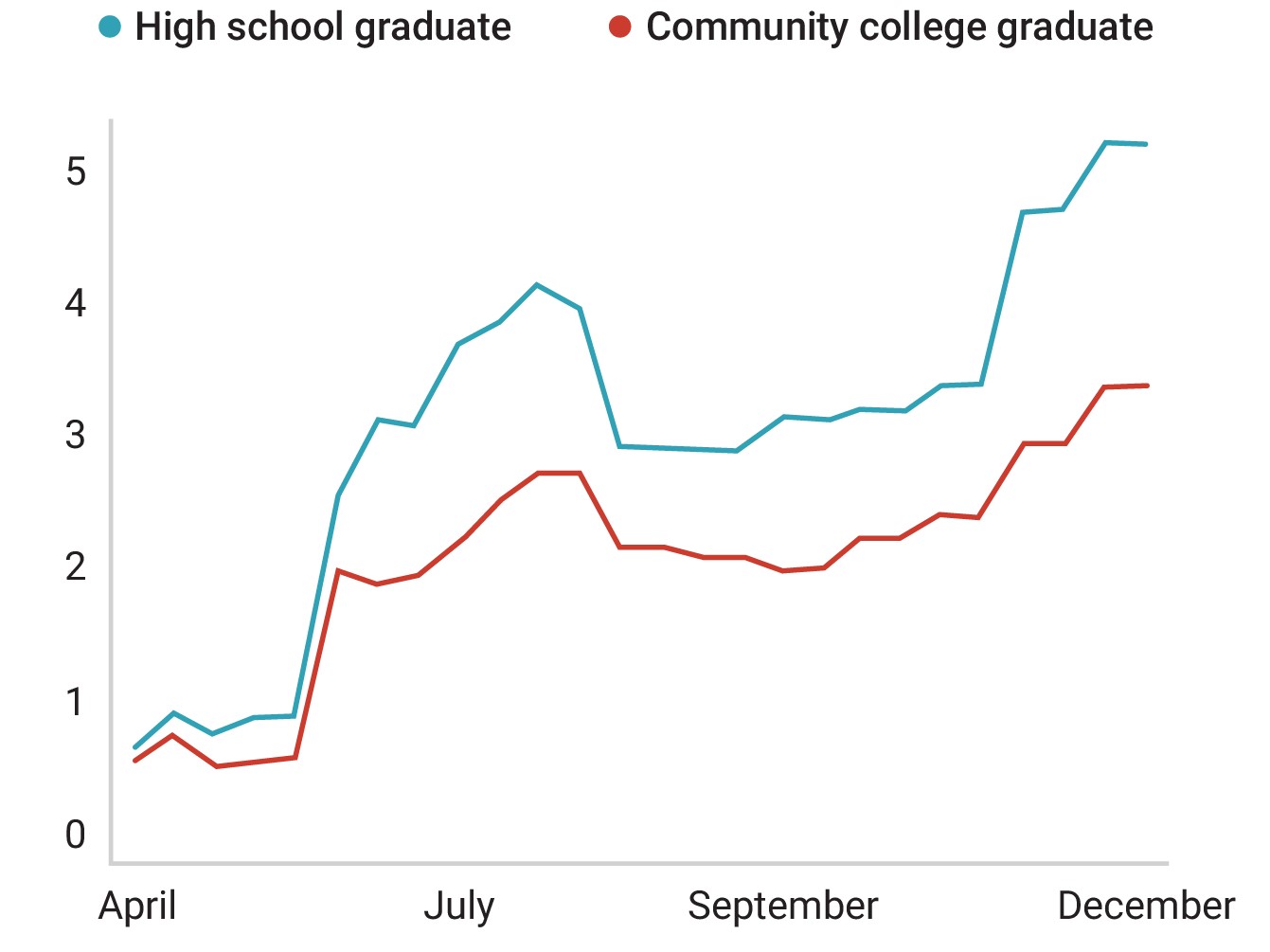

White-Collar Workers Face Growing Job Insecurity Despite College Degrees

Recent corporate layoffs and rising unemployment among college graduates signal a concerning shift in white-collar job security. Companies are reducing headcount amid economic pressures and AI adoption, challenging the traditional employment advantages of higher education.

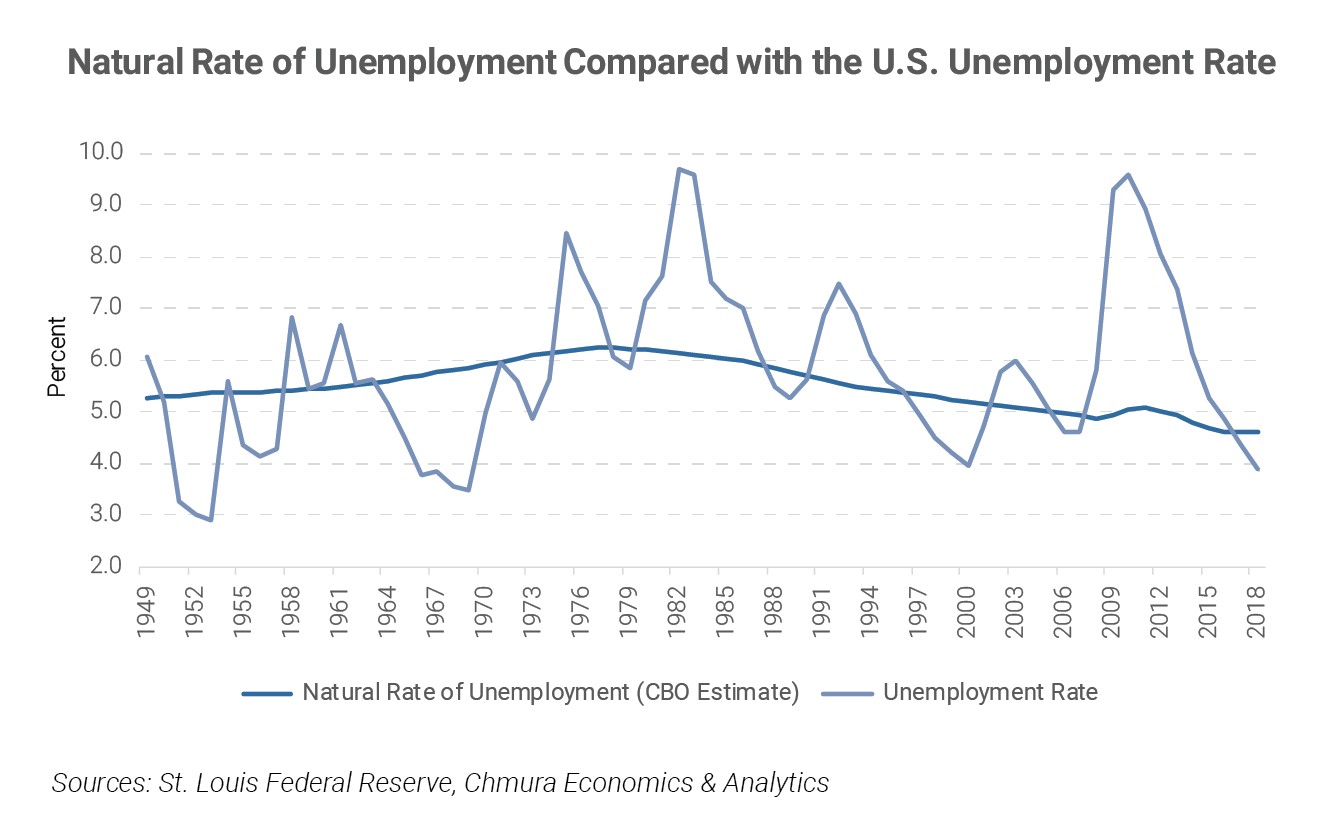

America's Unemployment Puzzle: How Low Can It Really Go?

The U.S. unemployment rate hit a 50-year low of 3.4% in 2023, raising questions about its theoretical minimum. While some regions achieve rates below 2%, economists warn that extremely low unemployment could signal economic instability rather than strength.

U.S. Jobless Claims Drop as Labor Market Shows Continued Resilience

The U.S. labor market remains robust with unemployment claims falling to 213,000, defying expectations amid low layoff rates. While some major companies announce workforce reductions, the broader job market maintains stability with a 4% unemployment rate and steady job growth.

Bipartisan Bill Proposes Historic 10% Cap on Credit Card Interest Rates

Senators Josh Hawley and Bernie Sanders introduce groundbreaking legislation to limit credit card interest rates to 10% for five years, aiming to provide relief for Americans struggling with over $1.1 trillion in credit card debt. Banking industry groups strongly oppose the measure, warning of reduced access to credit and potential shifts toward riskier lending options.

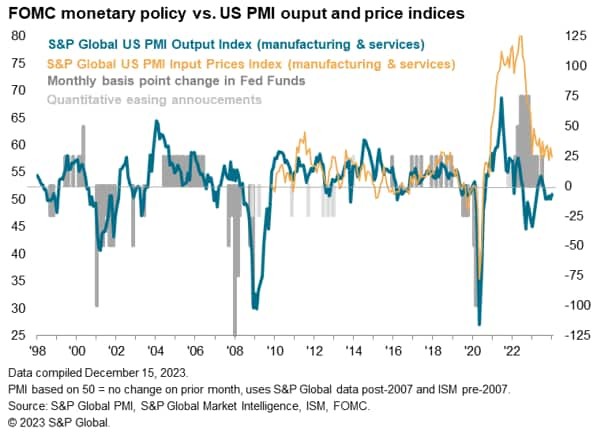

US Service Sector Growth Accelerates as Price Pressures Mount

The ISM services index climbed to 54.1 in December 2023, with the prices paid component hitting its highest level in nearly a year. While the sector shows resilience, rising costs and potential policy shifts create uncertainty for businesses navigating inflation pressures.

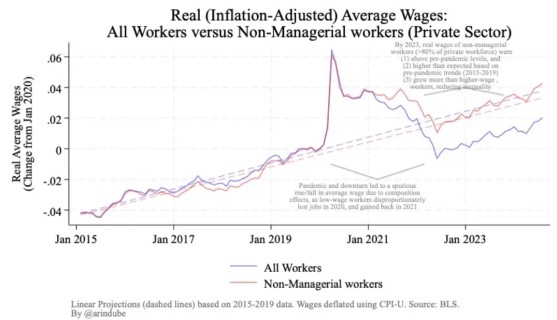

Real Wages Fall Behind: Inflation Outpaces US Worker Pay Gains Since 2021

Despite steady increases in private sector hourly wages reaching $34.61 by late 2024, persistent inflation has eroded Americans' purchasing power. The trend became particularly severe in 2022 when inflation hit 8% while wages grew only 4.14%, creating one of the largest real wage declines in recent years.

Retirement Crisis Looms: One-Third of Older Homeowners May Never Stop Working

A troubling survey reveals 29% of American homeowners over 50 doubt their ability to retire as planned, with many expecting to work indefinitely. Financial pressures, including insufficient savings, rising costs, and inflation, are forcing difficult choices between retirement plans and daily expenses.

Canada's Labor Market Paradox: Job Growth Overshadowed by Rising Unemployment

Canada's unemployment rate hit 6.8% in November 2023, the highest since 2017, despite adding 50,500 new jobs. The surge in joblessness was driven by labor force expansion outpacing job creation, while wage growth showed signs of cooling.

U.S. Job Market Shows Resilience with 227,000 New Jobs in November Despite Rising Unemployment

The U.S. economy demonstrated remarkable strength in November, surpassing expectations with 227,000 new jobs across healthcare, leisure, and government sectors. While unemployment ticked up to 4.2%, robust wage growth and positive market responses signal continued economic resilience.