Half of Gen Z Graduates Now Regret Their College Investment

A recent Indeed survey reveals that 51% of Gen Z graduates view their college degrees as financially wasteful, far surpassing the skepticism of older generations. With soaring education costs, mounting student debt, and AI disruption, young graduates increasingly question traditional higher education pathways.

Gen Z Crisis: 4.3 Million Young Americans Jobless as College Degree Value Questioned

Over 4 million Generation Z members in the US are neither employed nor in education, sparking debate about the value of traditional degrees. Experts recommend alternatives like skilled trades while calling for systematic changes in career guidance and education-to-employment pathways.

Financial Support Crisis: Parents Spending $1,500 Monthly on Adult Children

Half of parents now financially support their adult children, spending an average of $1,474 monthly on expenses from housing to groceries. This growing trend reflects mounting economic challenges faced by younger generations, including lower wages, student debt, and rising living costs.

The Economic Forces Driving Young Adults' Shrinking Social Circles

Modern financial pressures and career demands are fundamentally reshaping how young people form and maintain friendships. Recent data shows a strategic shift toward smaller, more intentional social networks as young professionals prioritize financial stability over extensive social circles.

Half of Millennials Rely on Tax Refunds for Basic Living Expenses

A Credit Karma survey reveals 50% of millennials depend on tax refunds to cover monthly expenses, compared to 37% of all taxpayers. The concerning trend highlights growing financial pressures on young adults, with many willing to pay fees for early refund access.

AI vs. Gen Z: Employers Prefer Automation Over Recent Graduates

A revealing survey shows 37% of employers would choose AI systems over hiring recent college graduates, citing concerns about workplace readiness. The study by Hult International Business School exposes a widening gap between academic preparation and job requirements, with 96% of employers stating colleges aren't adequately preparing students.

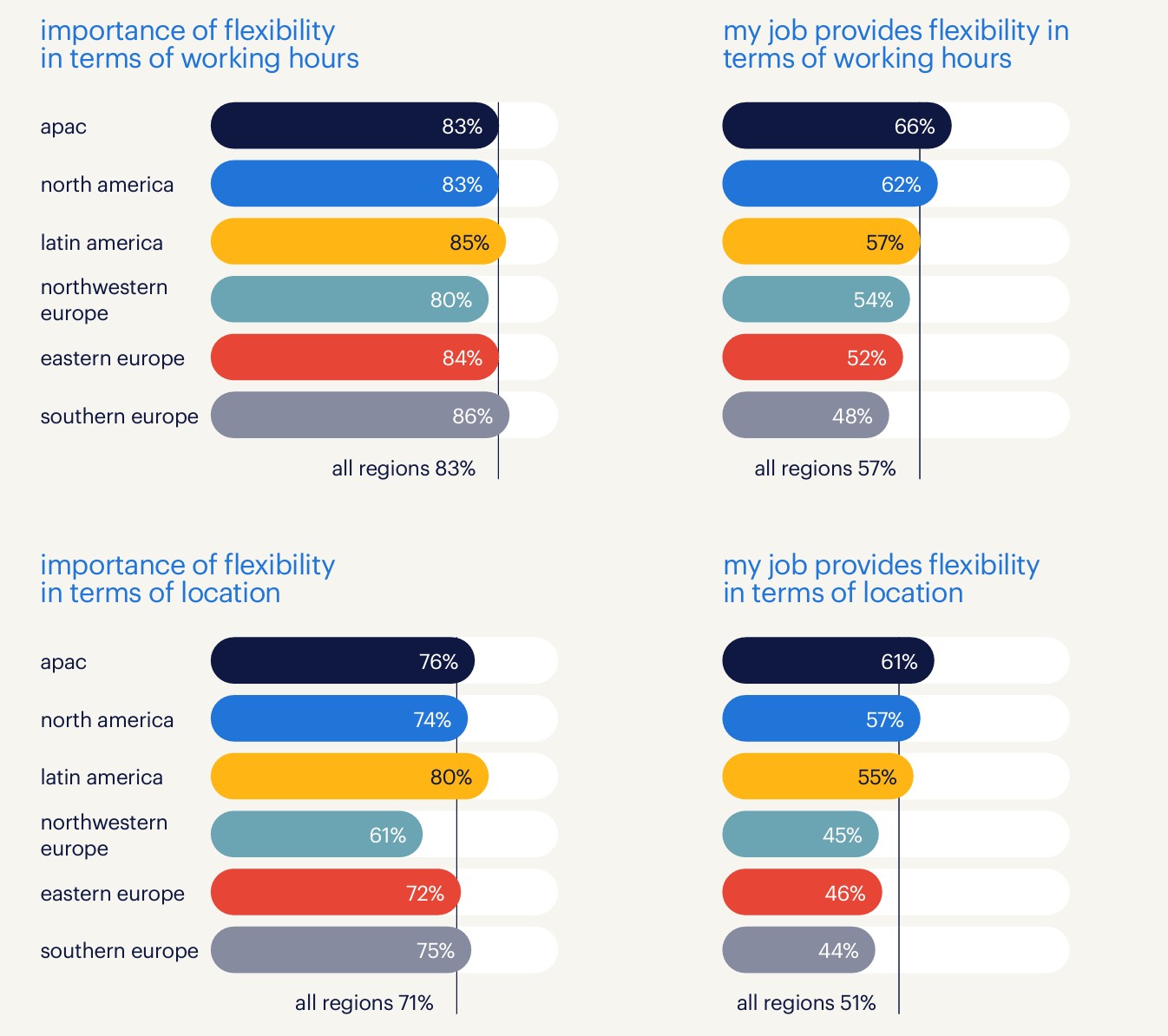

Global Survey: Work-Life Balance Overtakes Salary as Top Employee Priority

A landmark Randstad survey reveals that 83% of global workers now prioritize work-life balance over compensation, marking a historic shift in workplace values. The study shows increased demands for flexibility and community, with younger generations leading this transformative change in work culture.

Generation Z Sets Unprecedented $9.5M Target for Financial Success

A new survey reveals Gen Z believes they need nearly $9.5 million to achieve financial success, almost double what Gen X parents consider necessary. This stark generational divide reflects young adults' response to economic uncertainties and their observations of older generations' retirement struggles.

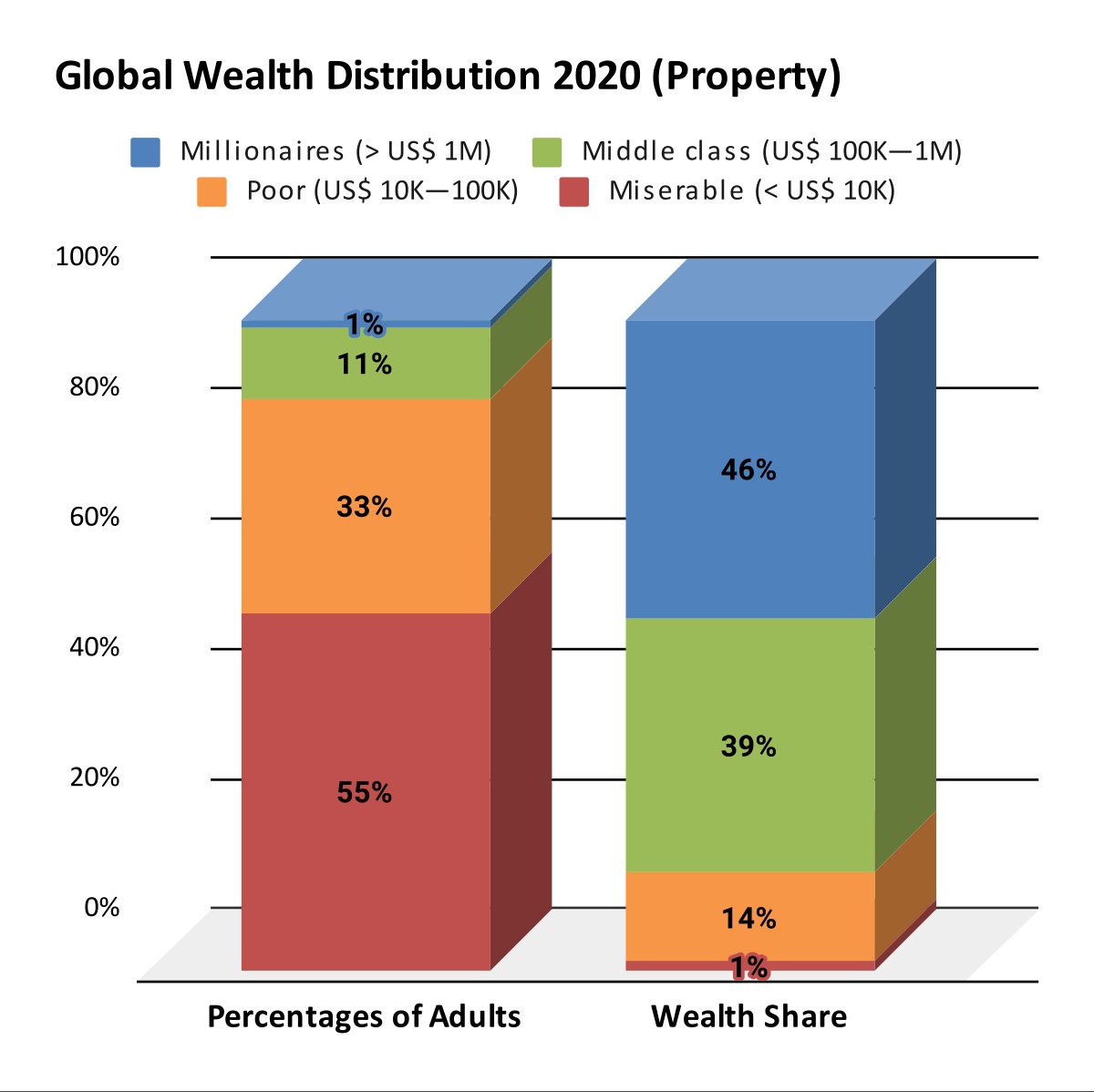

The New American Wealth: 7 Key Salary Thresholds Defining Rich in 2024

From tax brackets to generational expectations, new data reveals the evolving salary benchmarks that define wealth in America today. Analysis shows Americans now believe they need $520,000 annually to feel rich, while persistent inflation continues reshaping financial aspirations.

Gen X Parents Face Financial Strain Supporting Adult Children into Adulthood

A U.S. Bank survey reveals 53% of Gen X parents worry about financially supporting their adult children, spending an average of $1,384 monthly. This 'sandwich generation' faces unique pressures while balancing support for both aging parents and adult children in today's challenging economic landscape.