AI Revolution Could Eliminate 200,000 Wall Street Jobs by 2028

Major banks project cutting up to 10% of their workforce as artificial intelligence transforms financial operations, potentially boosting pretax profits by $180 billion. While back office and routine roles face highest displacement risk, industry leaders emphasize AI's role in augmenting rather than fully replacing human workers.

AI Revolution Set to Eliminate 200,000 Wall Street Jobs

Major financial institutions are preparing for a dramatic workforce transformation as AI technology reshapes banking operations, with analysts projecting 200,000 job losses. The shift is led by leading banks like RBC partnering with AI companies, though experts note new roles in AI development will emerge.

AI Revolution in Banking: 200,000 Wall Street Jobs at Risk Over Next Five Years

Major global banks could eliminate up to 200,000 positions as artificial intelligence increasingly automates traditional roles, with potential cuts of 3-10% of total workforce. The technology shift could add $180 billion to pretax earnings by 2027 through AI-powered productivity gains.

JPMorgan Ends Remote Work Era with Mandatory Full-Time Office Return

JPMorgan Chase is set to eliminate hybrid work arrangements, requiring all 300,000+ employees to return to office five days per week. The move signals a definitive shift away from pandemic-era flexibility and could influence other major financial institutions to follow suit.

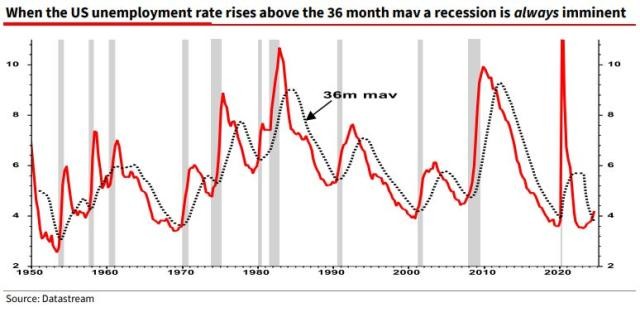

US Labor Market Signals Recession Risk Despite Wall Street Optimism

Société Générale analysts warn of potential US recession as November's unemployment rate surpasses key threshold. The concerning labor market indicator, which has preceded every economic downturn since 1950, contrasts sharply with Wall Street's bullish outlook for 2024.

Wall Street Billionaires Exploit Medicare Tax Loophole, Paying Zero While Workers Pay Full Share

While average Americans contribute to Medicare through mandatory payroll taxes, wealthy Wall Street executives like Steve Cohen and Stephen Schwarzman have found ways to completely avoid these payments. The controversial tax strategy highlights growing inequities between working-class obligations and billionaire exemptions in America's healthcare funding system.